Modern bookkeeping for small and growing businesses in 2026 is no longer about manual data entry; it is about real-time visibility, automation, and decision-ready financials. With cloud accounting adoption now standard among high-growth companies, relying on outdated methods creates significant operational risk.

- Who it’s for: Small and growing businesses, mid-sized companies, and startups.

- What it solves: Financial visibility gaps, compliance risks, and the need for decision-ready numbers.

- How it works: Through the use of cloud tools, automated integrations, and standardized workflows.

Key Takeaways

Modern bookkeeping in 2026 means cloud-based, automated, and audit-ready small business bookkeeping.

- Bookkeeping is the foundation of financial clarity and compliance for small and growing businesses.

- Choosing between cash vs accrual accounting can significantly change how profitability appears.

- A disciplined monthly close checklist improves decision-making and cash flow control.

- Automation and cloud accounting tools reduce errors and save time.

- Remote teams need standardized bookkeeping workflows to maintain consistency.

- Audit-ready books can be maintained year-round with modern bookkeeping processes.

- Outsourcing bookkeeping helps businesses scale efficiently without adding headcount.

Why Modern Bookkeeping Matters in 2026

Modern bookkeeping matters in 2026 because small and growing businesses face tighter compliance, faster reporting expectations, and more scrutiny from investors and lenders. In our work with growing businesses, this gap between available technology and execution is usually what drives bookkeeping problems.

In 2026, the marketplace moves faster than ever. Stakeholders demand real-time dashboards and clean books to produce accurate forecasts. Tools like QuickBooks Online, NetSuite, Ramp, and AppFolio have reshaped what “normal” looks like for a finance department.

Common pain points for businesses include:

- Delayed month-end closes and slow reporting.

- Cash flow blind spots that hinder growth.

- Messy reconciliations and uncategorized transactions.

- Inaccurate financial reporting and weak audit readiness.

What Is Modern Bookkeeping for Small Businesses?

Modern bookkeeping is the cloud-based, automated, and systematic recording, classification, and reconciliation of a business’s financial transactions for small and growing businesses.

Modern bookkeeping transforms simple recording into a strategic function. It includes several key elements:

- Cloud-based accounting systems: Access to data from anywhere at any time.

- Automated integrations: Direct links between bank, payroll, and expense platforms.

- Real-time dashboards: Instant visibility into key financial metrics.

- Structured monthly closes: A repeatable process to ensure accuracy.

- Compliance-ready documentation: Digitally organized files for audits or tax season.

In short, modern bookkeeping transforms financial data into actionable business intelligence for small and growing businesses.

Why Modern Bookkeeping Matters for Growing Businesses

Modern bookkeeping is essential because it connects day-to-day transactions to decision-ready financials and regulatory compliance for small and growing businesses. Without reliable books, even profitable companies we see can struggle due to poor financial visibility.

Key benefits include:

- Ensures accurate financial reporting for internal and external stakeholders.

- Supports tax and regulatory compliance to avoid penalties.

- Enables data-driven decision-making for founders and managers.

- Improves cash flow management to ensure operational stability.

- Builds investor and lender confidence during capital raises or loan applications.

Cash vs Accrual Accounting: What Founders Get Wrong

Founders of small and growing businesses often struggle with choosing the right accounting basis, frequently confusing simple cash tracking with long-term financial accuracy. Founders we work with often start on a cash basis and only see the problems once they begin fundraising or facing audits.

Many founders choose cash basis for its simplicity but later realize that it:

- Overstates cash health by ignoring upcoming liabilities.

- Distorts profitability by not matching revenue with related expenses.

- Creates issues during fundraising or audits where GAAP compliance is expected.

Accrual accounting provides a truer financial picture for growing businesses by recording transactions when they are earned or incurred, regardless of when cash moves.

Monthly Close Checklist for Small & Mid-Sized Businesses

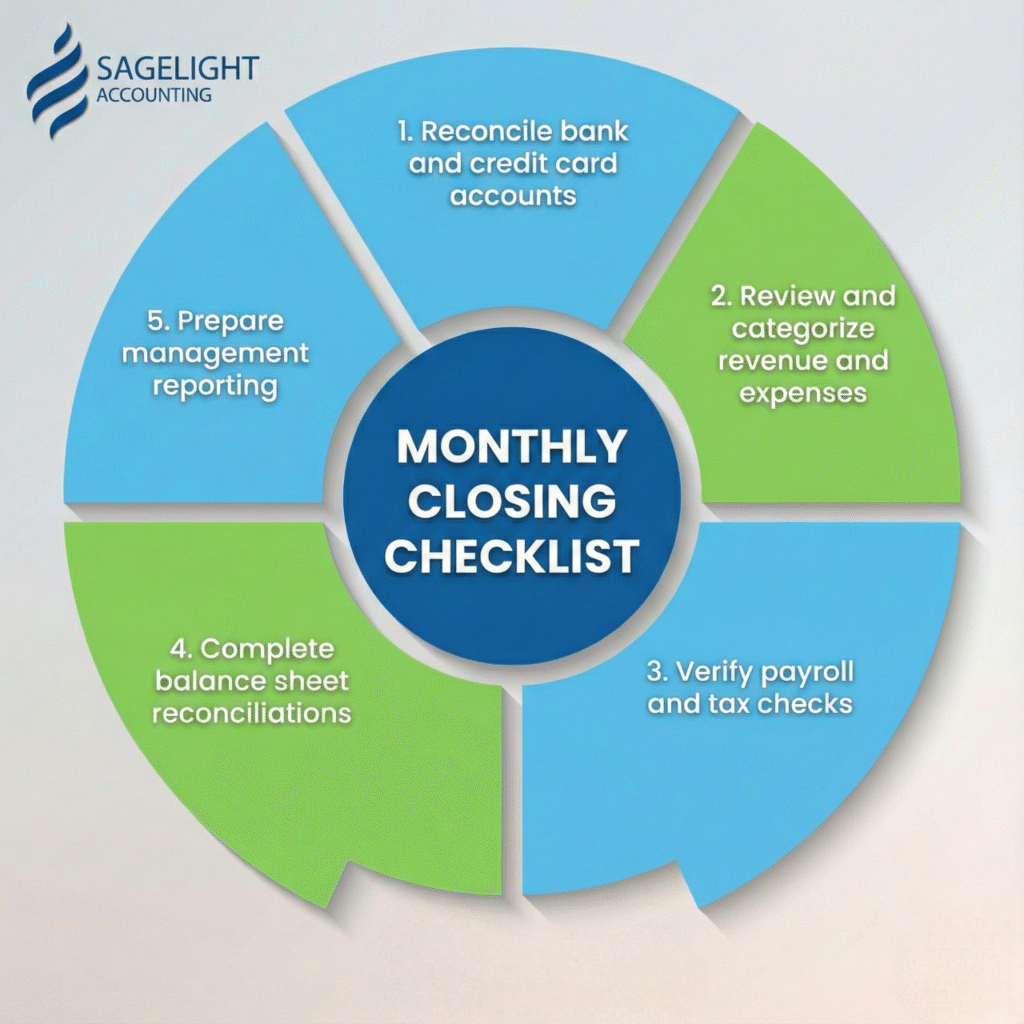

A disciplined monthly close keeps books accurate, audit-ready, and usable for the leadership of small and growing businesses. Maintaining this discipline ensures that financial data is a reliable tool for management rather than a historical afterthought.

The Modern Monthly Close Checklist:

- Reconcile bank and credit card accounts: Ensure every cent is accounted for.

- Review and categorize revenue and expenses: Check for misclassifications.

- Verify payroll and tax checks: Confirm all payroll accruals are accurate.

- Complete balance sheet reconciliations: Validate assets and liabilities.

- Prepare management reporting: Review the final numbers for trends.

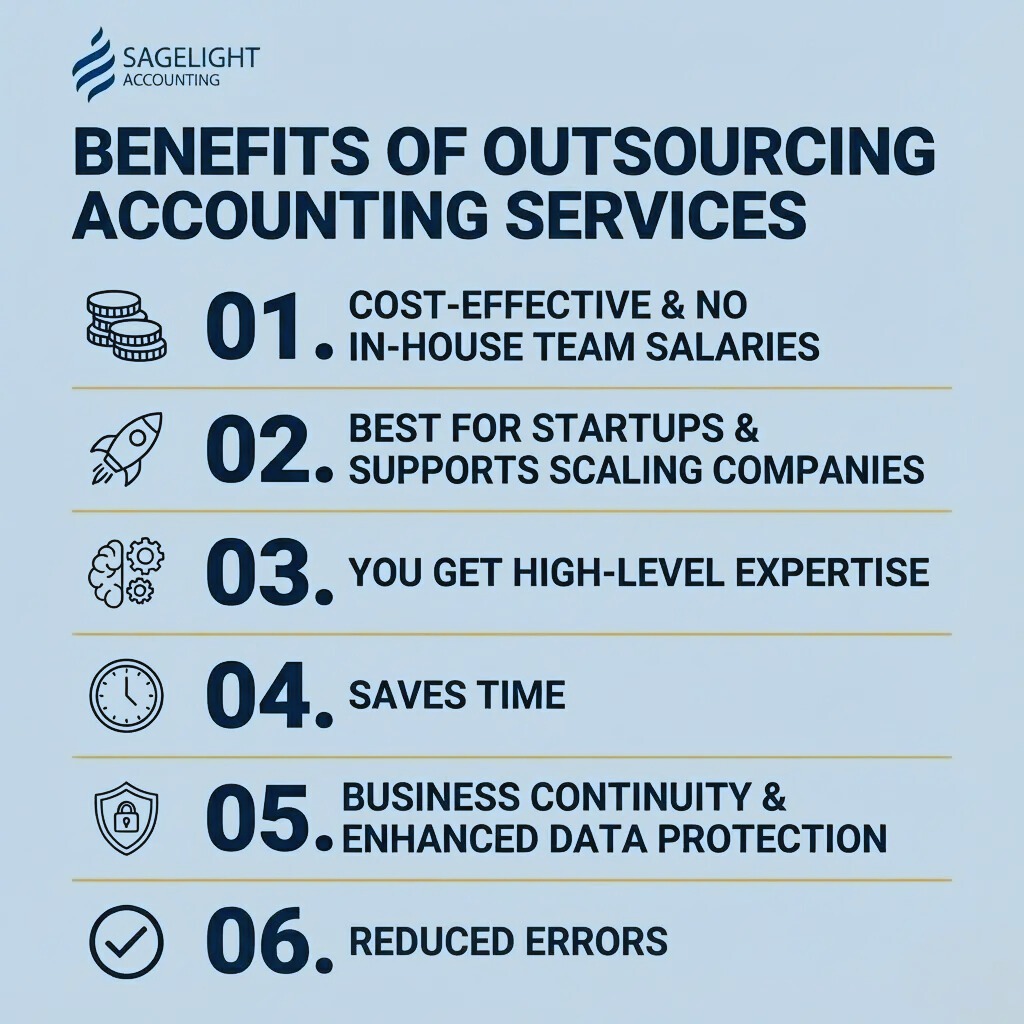

Outsourced vs In-House Accounting: When to Switch

The right accounting model depends on the growth stage, complexity, and internal capacity of small and growing businesses. As companies scale, the overhead of a full-time in-house team often outweighs the benefits compared to modern external solutions.

- In-house accounting: Works best for larger, stable teams with predictable, high-volume workloads that require daily on-site presence.

- Outsourced accounting: Works best for startups and scaling companies that need high-level expertise without the fixed overhead of full-time salaries.

- Hybrid models: Many modern firms mix internal administrative control with external specialist support for complex tasks.

How Modern Bookkeeping Improves Accuracy and Growth

Modern bookkeeping explicitly reduces manual entry errors and supports faster growth by providing clear financial pathways for small and growing businesses.

How accuracy helps:

- Automation reduces manual bookkeeping errors by pulling data directly from sources.

- Cloud workflows speed up close cycles, moving from weeks to just a few days.

- Real-time reports reveal profitability and cash flow trends as they happen.

- Finance data aligns better with business strategy and long-term planning.

Supporting Compliance, Advisory, and Cloud Operations

- Cloud-based bookkeeping keeps documentation organized and audit-ready at all times.

- Standardized workflows support scalable compliance across different teams and locations.

- Centralized reporting helps advisors deliver higher-value insights to business owners.

Best Practices, Tools, and Strategies for Modern Bookkeeping

Managing modern bookkeeping effectively requires a blend of the right technology and disciplined strategies tailored for small and growing businesses.

Tools

- Use cloud accounting platforms such as QuickBooks Online, NetSuite, and AppFolio.

- Automate expenses with tools like Ramp to eliminate manual receipt tracking.

Processes

- Standardize the chart of accounts to ensure consistent reporting.

- Automate recurring transactions and common workflows to save time.

- Maintain documentation year-round so you are always ready for tax season.

Controls

- Implement approval workflows for all outgoing payments.

- Set appropriate user permissions and access controls within your financial systems.

Common Challenges in Modern Bookkeeping

Even with the best tools, small and growing businesses still face significant implementation and maintenance challenges. Modern systems are only as good as the data and controls surrounding them.

Common problems include:

- Disconnected or poor system integrations between tools.

- Inconsistent transaction categorization leading to messy reports.

- Lack of internal controls and approval hierarchies.

- Compliance gaps in tax or industry-specific regulations.

- Limited internal financial expertise to troubleshoot complex issues.

Role of Compliance, Planning, and Budgeting

Without structured bookkeeping, budgets become unreliable and strategic planning suffers because the underlying data is untrustworthy. Compliance risks also increase as records become disorganized. This is where experienced accounting partners add value by tightening processes and controls.

How to Manage Modern Bookkeeping Effectively

Managing modern bookkeeping effectively requires choosing the right accounting basis, implementing the correct tools, and maintaining monthly discipline.

Steps to follow:

- Choose the right accounting basis (cash vs accrual) for your current stage of growth.

- Implement cloud accounting software suited for small and growing businesses.

- Automate recurring transactions and standard workflows to reduce manual labor.

- Close the books every month with a defined, repeatable checklist.

- Review financials with your accounting advisor or finance partner regularly.

- Maintain audit-ready documentation throughout the year to simplify year-end tasks.

Frequently Asked Questions about Modern Bookkeeping

1. What is modern bookkeeping?

Modern bookkeeping is cloud-based, automated, and insight-driven bookkeeping for small and growing businesses. It leverages technology to provide real-time financial data.

2. Is cash or accrual better for small businesses?

Accrual accounting is usually better for growing small businesses because it shows revenue and expenses when they are earned and incurred, providing a more accurate picture of long-term health.

3. How often should books be closed?

Small and growing businesses should close their books monthly to ensure financial data remains relevant and accurate.

4. Why outsource bookkeeping for small businesses?

Bookkeeping can be outsourced, and this is often more cost-effective for growing companies than hiring full-time staff who require benefits and overhead.

5. What tools are used in modern bookkeeping?

Modern bookkeeping commonly uses tools like QuickBooks Online, NetSuite, Ramp, AppFolio, and payroll integrations such as Gusto and Justworks.

6. How does bookkeeping help with audits?

Clean, reconciled, and documented books significantly reduce audit stress by providing a clear and verifiable trail of all financial activity.

How Sagelight Accounting Supports Modern Bookkeeping

Sagelight Accounting connects small and growing businesses to the efficiency and clarity of modern bookkeeping. We act as your long-term finance partner, ensuring your books support your growth rather than slowing it down.

- We clean, maintain, and optimize your books using modern cloud accounting tools.

- We implement best-in-class accounting systems tailored for your specific stage of growth.

- We deliver clear, actionable financial reports that support critical business decisions.

- We act as your long-term finance partner, not just a year-end vendor.

Ready to upgrade your bookkeeping for 2026 and beyond? Book a free consultation with Sagelight Accounting to review your current bookkeeping setup.