Cash flow management is the practice of tracking, forecasting, and controlling when money moves in and out of your business. It covers three core areas: monitoring inflows from customers and financing, controlling outflows to vendors and payroll, and planning for future liquidity needs.

Poor cash flow management, not lack of profit, is the leading reason growing businesses fail. You can show strong revenue and healthy margins on paper while running out of cash to make payroll or pay critical vendors.

This guide shows CFOs, controllers, and business owners how to build a reliable cash flow management system that prevents surprises and supports confident decision making.

Key Takeaways

- Cash flow management keeps your business funded while you grow, preventing cash shortages despite strong revenue

- It focuses on timing and reliability of cash, not just revenue and profit on the income statement

- Strong cash flow management systems provide visibility 13 weeks and 12 months ahead for better planning

- Cash flow management services help you prioritize payments, accelerate collections, and secure funding proactively

- Growing businesses and real estate portfolios benefit most from disciplined business cash flow management

- Sagelight combines tools, processes, and CFO insight so you manage cash with systems, not spreadsheets

Why Cash Flow Management Matters

Many profitable businesses run into cash crises because they confuse accounting profit with available cash. Revenue gets recorded when you invoice, but cash arrives weeks or months later. Expenses get paid immediately even when the economic benefit spans years.

Common Cash Flow Problems

1. Profitable But Cash Poor

A $10M ecommerce brand grows 40% year over year with healthy margins. They invest heavily in inventory for Q4, pay suppliers 30 days in advance, but collect from customers 45 days after shipment. Despite strong profits, they cannot cover November payroll without emergency financing.

2. Surprise Tax and Payroll Crunches

Quarterly tax payments, annual insurance renewals, and bonus payouts create predictable cash demands that feel like surprises when you lack a cash flow management system. These obligations crush businesses that only look at their bank balance today instead of 90 days ahead.

3. Supplier Pressure and Missed Opportunities

Without clear visibility into managing cash flow, you delay vendor payments to preserve cash, damaging relationships and losing early payment discounts. You pass on strategic acquisitions or equipment upgrades because you cannot confidently assess available cash.

4. Aggressive or Ill-Timed Investor Distributions

Investors naturally expect a return on their investment, whether through Return of Capital, profit distributions, or mandatory interest on loan notes. This forces the business into a liquidity trap, often requiring expensive bridge financing or embarrassing capital calls to survive.

How Disciplined Cash Flow Management Reduces Risk

Strong business cash flow management eliminates late fees, reduces emergency borrowing costs, and prevents the stress of constant financial firefighting. You make decisions based on data instead of gut feel. Investors, lenders, and landlords evaluate your cash flow track record before committing capital or space. Clean cash flow forecasting demonstrates operational control and reduces their perceived risk.

Sagelight clients using structured cash flow management services report 60% fewer cash surprises and 40% less time spent on emergency cash planning compared to managing cash flow in spreadsheets alone.

Core Components of Effective Cash Flow Management

Building a reliable cash flow management system requires three integrated elements: visibility into current position, forecasting of future needs, and controls to execute your plan.

Visibility Into Current Cash Position

Start with weekly and monthly cash flow reports by entity, project, or fund. Simple dashboards should show current cash runway (how many months of operating expenses you can cover), upcoming peaks and valleys, and concentration risks like dependence on a single customer payment.

Real time visibility requires clean accounting data. If your books are three weeks behind or riddled with errors, your cash reports will mislead rather than inform. This is where Sagelight’s outsourced accounting foundation becomes critical for reliable cash flow management.

Forecasting Short and Long Term Needs

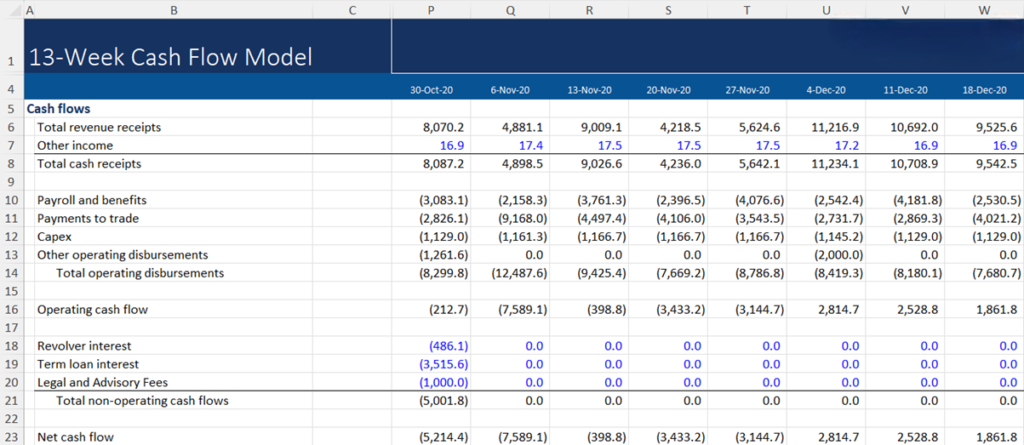

1. 13 Week Cash Flow Model

The 13 week cash flow model is the operational heartbeat of business cash flow management. Updated weekly, it shows expected cash receipts and disbursements for the next 13 weeks, reconciles to actual bank balances, and informs immediate decisions about payment timing and collection priorities.

CFOs use the 13 week cash flow model to answer questions like: Can we make this acquisition payment in week 8? Should we draw on our credit line now or wait? Which vendor payments can we delay without damaging relationships?

2. Longer Term Cash Projections

Beyond 13 weeks, you need 12 to 18 month projections for strategic decisions like hiring plans, capital expenditures, debt refinancing, and equity raises. These projections tie to your budget and business plan but adjust monthly as conditions change.

3. Controls and Operating Discipline

Strong cash flow management best practices include payment approval rules, structured collection playbooks, and spending thresholds that trigger additional review. Establish standard cadences for updating forecasts and reviewing variances between projected and actual cash flows.

Without discipline, even sophisticated cash flow management systems fail. The forecast becomes a document you create once per quarter and ignore until the next crisis.

What is 13 Week Cash Flow Model

The 13 week cash flow model is a rolling forecast that shows weekly cash receipts, disbursements, and ending balances for the next 13 weeks. It reconciles to your current bank balance and updates every week by dropping the oldest week and adding a new week 13 weeks out.

Why 13 Weeks Matters

Thirteen weeks covers one full quarter, capturing seasonal patterns, tax payment cycles, and typical customer payment delays. It is granular enough to inform operational decisions but not so detailed that updating it becomes burdensome.

Weekly granularity forces discipline. Monthly cash forecasts hide timing problems that weekly models surface immediately.

What Goes Into the Model

Cash Receipts Section

List expected customer payments by week based on accounts receivable aging, payment terms, and historical collection patterns. Include other inflows like draws on credit lines, equity injections, or asset sales.

Cash Disbursements Section

Group outflows into categories: payroll and taxes, vendor payments, debt service, capital expenditures, and owner distributions. For variable expenses like inventory purchases, tie projections to sales forecasts and lead times.

Reconciliation to Bank Balance

Start each week with actual bank balance, add projected receipts, subtract projected disbursements, and calculate ending cash. Compare projected ending cash each week to your minimum operating cash target.

Decisions the 13 Week Cash Flow Model Informs

A real estate developer uses their 13 week cash flow model to decide whether to start construction on a new property in week 6 or delay until week 10 when a significant tenant payment arrives. Without the model, they would have started early and faced a cash shortfall in week 8.

An ecommerce brand sees their 13 week cash flow model projecting negative cash in week 9 due to inventory purchases. They accelerate collection efforts on past due accounts, delay a planned equipment purchase by two weeks, and negotiate extended terms with their largest supplier.

Sagelight builds and maintains 13 week cash flow models as a standard component of cash flow management services for fractional CFO clients, updating weekly and reviewing variances with leadership.

Cash Flow Management for Small and Growing Businesses

Small businesses and growth stage companies face distinct cash flow management challenges that require tailored approaches.

Common Challenges

1. Uneven Sales Cycles

Seasonal businesses, project based companies, and early stage ventures experience extreme cash volatility. A landscaping company generates 70% of annual revenue between April and September but maintains overhead year round. Their cash flow management system must account for this predictable unevenness.

2. Owner Draws and Personal Expenses

Many small business owners blur the line between business and personal cash. Disciplined cash flow management for small business includes planned, consistent owner distributions rather than arbitrary withdrawals that destabilize the business.

3. Concentrated Customer Risk

When your top three customers represent 60% of revenue, one late payment or lost contract creates immediate cash stress. Your 13 week cash flow model should flag this concentration and plan for contingencies.

4. Limited Access to Credit

Large companies can draw on revolving credit lines or issue commercial paper to smooth cash timing. Small businesses often lack these options, making proactive cash flow management even more critical.

Simple Best Practices to Improve Cash Flow

Invoice Discipline

Send invoices immediately upon delivery, not at month end. Include clear payment terms and instructions. Follow up on day 31 for 30 day terms, day 46 for 45 day terms.

Deposit Schedules

For project based work, structure payment terms to collect deposits upfront (30%), progress payments at milestones (40%), and final payment upon completion (30%). Never start projects fully self funded.

Collection Call Scripts

Train your team on professional collection conversations. Call customers on day 31, send formal notices on day 45, and escalate to collections on day 60. Inconsistent collection discipline destroys cash flow.

Early Warning Triggers

Set automatic alerts when cash falls below your minimum operating threshold (typically 45 to 60 days of expenses) or when accounts receivable aging shows more than 20% past 60 days.

A structured cash flow management system replaces reactive, seat of the pants decisions with predictable routines that improve cash flow systematically.

Processes and Tools for Modern Cash Flow Management

Effective business cash flow management combines disciplined processes with the right technology stack.

Our Proven Process

Weekly Routines

Every Monday morning, your controller or CFO should update the 13 week cash flow model with actual cash position from Friday, adjust weekly projections based on new information (invoices sent, vendor bills received, changed payment terms), and review variances between last week’s projection and actual results.

Flag any weeks where projected cash falls below your minimum threshold. Brief leadership on upcoming decisions the model surfaces.

Monthly and Quarterly Routines

Each month, reconcile your rolling 13 week projections against monthly management financials. Update longer term 12 to 18 month cash projections based on revised revenue forecasts, hiring plans, and capital expenditure timing.

Quarterly, run scenario analysis. What happens to cash if revenue drops 20%? What if your largest customer delays payment by 30 days? What credit line capacity do you need to weather a two quarter downturn?

Technology Stack for Cash Flow Management Systems

Accounting Platform as Foundation

Your core accounting system (QuickBooks, Xero, NetSuite, or property management software like Yardi) provides the transaction data that feeds cash flow management. Sagelight ensures this foundation is clean, current, and properly categorized.

Cash Flow Specific Tools

Dedicated cash flow management systems like Pulse, Float, or Jirav pull data from your accounting platform and add forecasting capabilities, visual dashboards, and scenario planning features.

Criteria for selecting a cash flow management system include native integration with your accounting platform, real time visibility into multiple bank accounts and entities, automated alerts for threshold breaches, and collaboration features so your team can discuss projections together.

Spreadsheet Models for Custom Needs

For complex businesses (multi entity real estate portfolios, funds with capital call schedules, project based developers), custom spreadsheet models often provide the flexibility you need. Sagelight builds these for clients and maintains them as an ongoing cash flow management service.

DIY vs Sagelight Cash Flow Management Services

| Aspect | DIY or In House | Sagelight Cash Flow Management Services |

|---|---|---|

| Data Quality | Depends on your bookkeeping discipline; often 2 to 3 weeks behind | Clean, current accounting maintained by outsourced accounting team |

| Forecasting Cadence | Irregular updates during crises; quarterly at best | Weekly 13 week cash flow model updates; monthly long term projections |

| 13 Week Discipline | Built once, rarely maintained | Standard deliverable reviewed every Monday with controller |

| Decision Support | You interpret the model alone | Fractional CFO provides context, scenarios, and recommendations |

| Lender and Investor Readiness | Requires scrambling when due diligence starts | Investor grade cash reporting ready on demand |

| Time from CFO or Owner | 5 to 10 hours per week minimum | 1 hour per week for review and strategic decisions |

Sagelight’s approach combines outsourced accounting for reliable data, controller services to enforce cash flow management best practices, and fractional CFO ownership of forecasting and scenario planning.

For real estate portfolios and funds, Sagelight provides property level and fund level cash views, not just one aggregated number that hides critical details.

Frequently Asked Questions

What is cash flow management and how is it different from budgeting?

Cash flow management tracks when money actually moves in and out of bank accounts, focusing on timing and liquidity. Budgeting plans spending and revenue targets based on accounting periods. You can’t meet budget while running out of cash if timing mismatches occur.

How often should a business update its cash flow management system?

Update your 13 week cash flow model weekly, your 12 month projections monthly, and run scenario analysis quarterly. Without weekly discipline, you lose the early warning value that makes managing cash flow effective.

Do small businesses really need a 13 week cash flow model?

Yes. Small businesses typically have less cash cushion and limited credit access, making them more vulnerable to cash surprises. A simple 13 week cash flow model prevents most cash crises and takes only 30 to 60 minutes per week to maintain once built.

What are cash flow management services and how do they work with my existing accountant?

Cash flow management services combine clean accounting data, forecast modeling, and CFO level analysis to keep you ahead of cash needs. If your current accountant provides only historical bookkeeping, Sagelight layers forecasting and advisory on top. If you lack accounting support entirely, we provide full service outsourced accounting plus cash flow management.

How can Sagelight help improve cash flow without cutting essential spending?

Most cash flow problems stem from poor visibility and timing, not overspending. Sagelight improves cash flow by accelerating collections, optimizing payment timing, and helping you make informed decisions about when to deploy cash versus preserve liquidity.

Why Sagelight

Sagelight delivers integrated cash flow management services across three layers of your finance function.

Foundation: Outsourced Accounting

Clean, current transaction processing ensures your cash data is reliable. We reconcile bank accounts weekly, code expenses properly, and close books within 5 to 7 days so your cash flow management system operates on accurate information.

Structure: Controller Services

Our controllers design and enforce cash flow management best practices including payment approval workflows, collection playbooks, and forecast update routines. We build your 13 week cash flow model and maintain it weekly as a standard deliverable.

Strategy: Fractional CFO Guidance

Fractional CFOs own long term cash projections, scenario planning conversations with leadership and investors, and strategic recommendations about financing, capital allocation, and liquidity management.

For real estate operators and fund managers, Sagelight provides property level and portfolio level cash visibility, capital call forecasting, and distribution planning that generic business cash flow management cannot match.

Conclusion

Disciplined cash flow management is non negotiable for any business that wants to grow without constant cash stress and emergency financing. Strong business cash flow management combines clean accounting data, a simple forecasting model like the 13 week cash flow model, and consistent review routines.

Most cash crises are preventable with proper visibility and planning. The difference between businesses that thrive and those that struggle often comes down to whether they manage cash proactively or reactively.

Take Control of Your Cash Flow Now

If cash keeps feeling like a guessing game, you don’t need another spreadsheet. You need a repeatable cash flow management system and a team to run it. Sagelight’s cash flow management services combine outsourced accounting, controller oversight, and CFO guidance so you always know what’s coming and what to do next. Schedule a 30 minute cash flow assessment to see where your business can gain clarity first.