In 2026, spreadsheet-based accounting is no longer just a slow process. It is a significant liability for lender trust and investor confidence. As interest rates remain elevated and margins tighten, the ability to provide real-time, unified financial data has become the primary differentiator for successful firms.

This guide serves as a strategic decision-making tool for finance leaders. The market has shifted away from siloed property management tools toward integrated systems that handle the entire lifecycle of a real estate investment. Selecting the best real estate accounting software in 2026 requires a balance of operational efficiency, institutional reporting, and regulatory compliance.

Key Takeaways

- Unified data models reduce the month-end close from 15 days to 3 days.

- ASC 842 and IFRS 16 compliance is now a native feature rather than a manual calculation.

- Real-time investor portals have become the baseline expectation for capital calls and distributions.

- AI-driven automated bank reconciliation eliminates up to 90% of manual data entry.

- Multi-entity consolidation is the most critical feature for scaling beyond a single asset.

- Implementation success depends more on data clean-up than on software features alone.

- Cloud-native security is essential to protect sensitive investor PII and banking data.

Why Real Estate Accounting Is More Complex Than Standard Accounting

Real estate accounting is uniquely difficult because it requires managing multiple layers of entities. You aren’t just managing a company; you are managing a web of Limited Liability Companies (LLCs), General Partnerships (GPs), and Special Purpose Vehicles (SPVs), all while tracking property-level operational data.

What you can do

Implement a hierarchical chart of accounts that allows for automated intercompany eliminations and real-time consolidation across all property entities.

Why it works

By structuring your data at the entity level first, you ensure that every transaction is tagged correctly for both property-level reporting and fund-level tax preparation. This prevents the “reconciliation nightmare” that occurs during the year-end when trying to untangle intercompany loans or shared expenses.

Here is how to manage Multi-Entity Management

- Standardize your chart of accounts across every property in the portfolio.

- Use automated intercompany journals to record “due to/due from” transactions instantly.

- Enable automated elimination entries to remove internal revenue and expenses during consolidation.

- Set up real-time roll-up reports that allow for a “one-click” consolidated balance sheet.

How Technology Is Transforming Real Estate Accounting

The best real estate accounting software in 2026 leverages artificial intelligence to move beyond record-keeping. Technology is now used to predict cash flow shortages and automate the most tedious parts of the job.

AI-driven forecasting now analyzes historical lease data and current market trends to provide predictive occupancy models. Furthermore, Automated Bank Reconciliation has evolved. Systems now use machine learning to recognize recurring patterns in utility bills, rent checks, and mortgage payments, matching them to the general ledger without human intervention. This shift allows the finance team to act as strategic advisors rather than data entry clerks.

Comparing NetSuite, Yardi, and QuickBooks

The landscape of 2026 is defined by three distinct tiers of software. Choosing the wrong one can either lead to “over-tooling” a small portfolio or “under-powering” an institutional fund.

QuickBooks: Best for Single-entity startups

QuickBooks remains the gold standard for small-scale residential owners or developers with fewer than five properties. It is cost-effective and easy to find staff who understand the interface. However, it lacks native multi-entity consolidation and sophisticated lease administration.

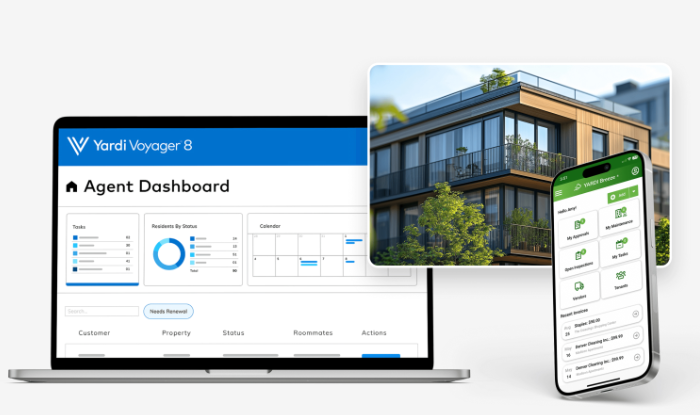

Yardi: Best for Operations-heavy property management

Yardi Voyager is the dominant player for firms focused on the “nitty-gritty” of property management. It excels in CAM (Common Area Maintenance) reconciliations, work order tracking, and tenant communication. It is a “property-first” system that is essential for commercial landlords with complex retail or office leases.

NetSuite: Best for Institutional-grade investment firms

NetSuite has become the preferred choice for real estate private equity and institutional funds. Unlike property-centric tools, NetSuite is a global ERP. It provides superior multi-book accounting, complex consolidation, and the highest level of ASC 842 compliance software capabilities. When comparing NetSuite vs Yardi for real estate, NetSuite wins on financial flexibility and reporting, while Yardi wins on physical property operations.

2026 Real Estate Feature Comparison

| Feature | QuickBooks Online | Yardi Voyager | NetSuite ERP |

| Portfolio Size | 1 – 5 Properties | 10 – 500+ Properties | Institutional / High Growth |

| Multi-Entity Consolidation | Manual / Third-party | Native (Ops Focused) | Native (Financial Focused) |

| Compliance (ASC 842) | No | Yes | Advanced |

| Implementation Complexity | Low (Days) | High (Months) | High (Months) |

| Investor Portal | No | Optional Add-on | Comprehensive Integration |

The 2026 Software Selection Matrix

Finance leaders must match their software to their growth trajectory. Use this matrix to identify your primary path.

| Portfolio Type | Primary Need | Recommended System |

| Small Residential | Speed & Cost | QuickBooks Online |

| Mid-Market Commercial | Ops & CAM Reconciliations | Yardi Voyager |

| Institutional Fund | Global Reporting & Scalability | NetSuite ERP |

| Development Heavy | Project Cost Tracking | Sage Intacct or NetSuite |

Technical & Compliance Elements

A critical factor in the 2026 selection process is the handling of the ASC 842 lease accounting standard. The best real estate accounting software in 2026 must automate the calculation of Right-of-Use (ROU) assets and lease liabilities. Relying on spreadsheets for these calculations is a red flag for auditors and significantly increases real estate ERP implementation risk.

Cloud security has also evolved. Top-tier providers now utilize zero-trust architecture and biometric authentication to protect the vast amounts of financial data stored in the cloud. As cyber-attacks target financial institutions, having a software provider with SOC 1 and SOC 2 Type II compliance is no longer optional.

Frequently Asked Questions

When is it time to move from QuickBooks to an ERP like NetSuite?

You should migrate when you manage more than 10 entities or require automated intercompany eliminations and consolidated financial reporting. Read our detail blog on how to migrate to Netsuite like a pro.

Does Yardi or NetSuite have better reporting for commercial real estate?

Yardi is superior for operational reports like rent rolls and CAM, while NetSuite provides better institutional financial reporting and fund-level analytics.

How does automation reduce real estate audit risk?

Automation creates an immutable audit trail and ensures that complex calculations, such as ASC 842 lease adjustments, are consistent and error-free.

What is the average implementation time for a real estate ERP?

A standard real estate ERP implementation typically takes between 3 to 6 months, depending on data cleanliness and the number of entities involved.

The Bottom Line

In 2026, the finance department will no longer be a back-office cost center. By utilizing the best real estate accounting software in 2026, finance leaders turn a record-keeping function into a strategic edge that attracts capital and mitigates risk. The shift from “lagging indicators” to “real-time insights” is only possible through a unified technology stack.

Partner with Sagelight Accounting to navigate your ERP implementation. Whether you are scaling out of QuickBooks or optimizing NetSuite, our experts ensure your data flows accurately from day one.