Manual bank reconciliation is a relic of the past. It’s slow, prone to errors, and a drain on your finance team’s time. The solution lies in automated bank data matching within NetSuite. This guide provides a clear, actionable framework for how to match bank data in Netsuite, connecting your bank accounts and efficiently matching transactions.

Key Takeaways

- NetSuite connects directly to banks to automatically import transaction data.

- Automated bank matching saves time, increases accuracy, and simplifies categorization.

- Bank disconnections are a common challenge that can disrupt financial workflows.

- Expert support is essential to quickly resolve disconnections and maintain data integrity.

- Third-party connectors like Plaid or Yodlee can provide more stable integrations.

- Manual import serves as a reliable backup when automated feeds fail.

- Regular connection checks are a key best practice to prevent disruptions

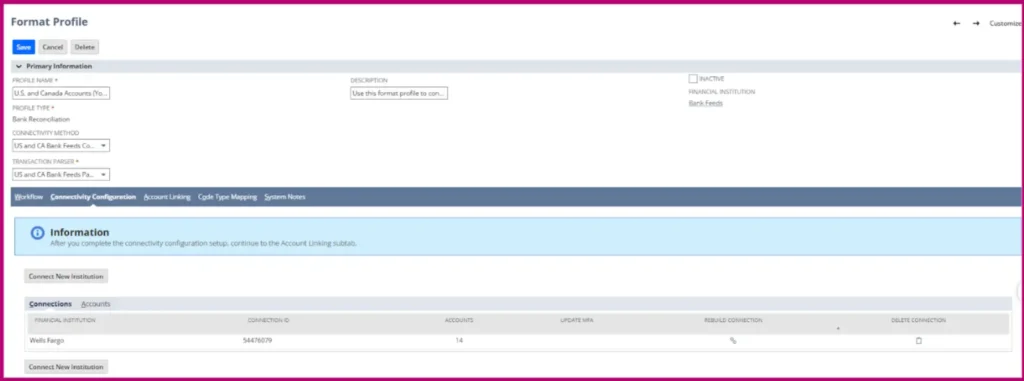

What is the NetSuite bank data import feature?

The NetSuite bank data import feature is a tool that allows you to connect your bank accounts directly to your NetSuite instance. This connection automatically imports your financial transactions, eliminating manual data entry. It serves as the foundation for automated rule to match bank data in NetSuite reconciliation, ensuring your general ledger always reflects your bank’s records.

What you can do

Leverage NetSuite’s native bank integration to pull transactions directly into your system. This removes the need for manual statement uploads.

Why it works

This method uses secure APIs to establish a real-time data link. It automates the data-gathering process, freeing your team to focus on matching and reconciliation.

Here’s how to do it

- Navigate to the bank data matching module in NetSuite.

- Select set up bank accounts and follow the prompts to connect your bank.

- Enter your online banking credentials.

- Authorize the connection and select the accounts you wish to import.

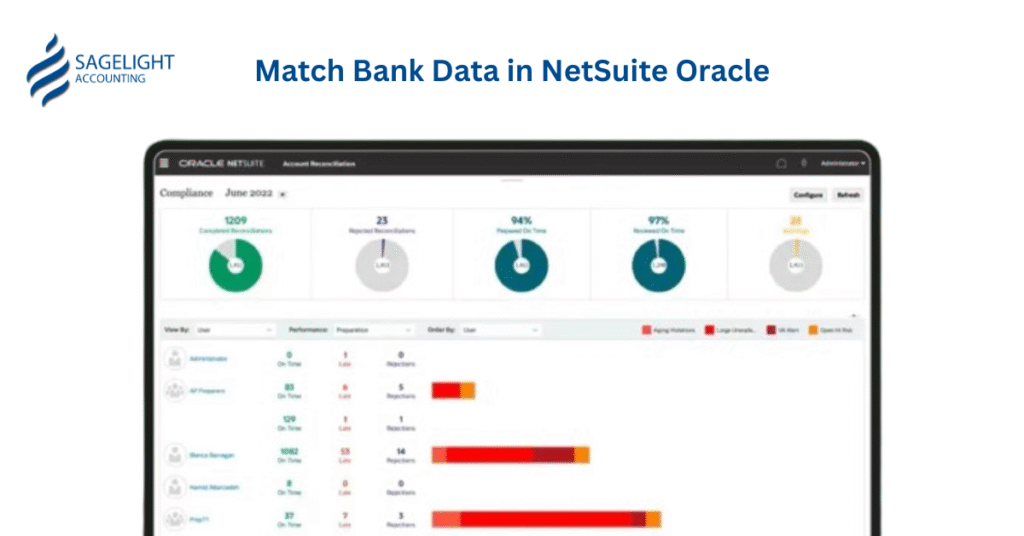

Why is an automated bank matching in NetSuite essential?

Automated matching bank data in Netsuite ensures accuracy and efficiency by directly comparing imported bank transactions with your NetSuite general ledger entries. This process identifies unmatched transactions, allowing for quick resolution and a smooth reconciliation.

| Aspect | Manual Bank Matching | Bank Matching |

| Efficiency | Requires manual data entry and comparison | Matches hundreds of transactions in seconds. |

| Accuracy | Prone to human error (typos, missed entries). | Relies on precise data comparison rules. |

| Visibility | Data is only as current as the last manual upload. | Provides a live view of your cash position. |

| Process | Requires exporting statements, formatting data, and uploading. | Automated via direct bank feed requires minimal user input. |

| Compliance | Audit trails can be difficult to maintain. | Creates a clear, unalterable digital audit trail. |

What you can do

Configure data matching rules within NetSuite to automatically link bank imports to your existing transactions.

Why it works

NetSuite uses rule-based logic to compare key fields like date, amount, and payee. This allows the system to auto-match transactions that meet predefined criteria, significantly reducing manual effort.

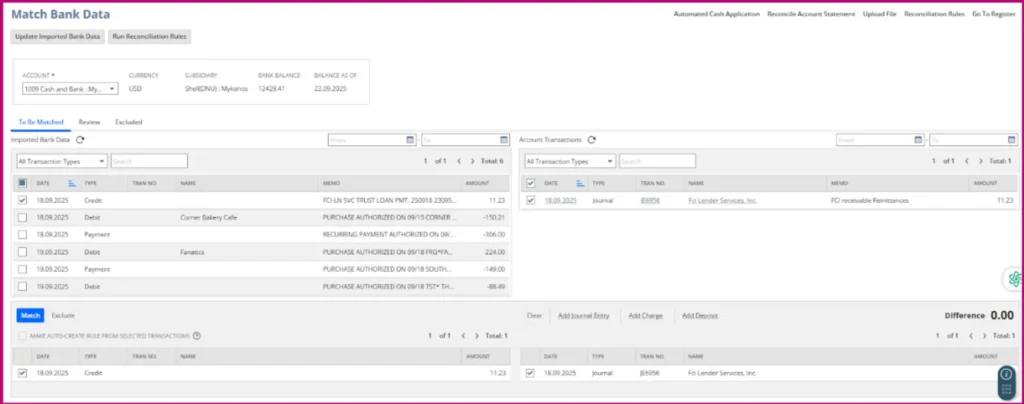

Here’s how to match bank data in NetSuite

- Navigate to Transactions > Bank > Match Bank Data.

- Review the list of imported bank transactions.

- Click the Match button to select corresponding general ledger entries.

- Use the Auto Match feature to apply predefined rules to a batch of transactions.

How to handle common bank connection issues?

Bank disconnections are a common challenge when relying on automated feeds. They are typically caused by security updates, expired authentication tokens, or multi-factor authentication (MFA) time-outs. A disruption in this data flow can cause panic and delay critical financial reporting.

What you can do

Proactively monitor your bank connection status and have a backup plan for manual imports.

Why it works

A proactive approach ensures you can quickly identify and resolve issues. Having a manual import process ready prevents delays and keeps your books current even when automation fails.

Here’s how to manage connection disruptions

- Check your NetSuite bank data matching dashboard for any alerts or failed imports.

- Attempt a re-authentication with your bank login credentials.

- If the issue persists, manually download the bank statement in a CSV or OFX format.

- Import the file into NetSuite via the import bank data feature to bridge the data gap.

Case Study: Resolving a client’s bank disconnection

A client in the IT services sector was frustrated by recurring problems with matching bank data in Netsuite, which disrupted their weekly reconciliations. Their internal team was spending hours troubleshooting and manually correcting data. The constant disruptions eroded trust in the automated system.

Sagelight Accounting stepped in. Our team immediately initiated a manual import to ensure no transactions were missed. We then coordinated with the client’s bank representatives and NetSuite administrators to diagnose the root cause: an expired token and a new MFA requirement.

We re-established the connection and implemented a monitoring protocol. This ensured the client’s bank feeds remained stable, minimizing future issues and restoring their confidence in the automation process.

Are there more reliable alternatives for bank integration?

For businesses that require exceptional stability, third-party connectors can offer a more robust solution as alternative to match bank data in netsuite. Services like Plaid and Yodlee specialize in providing stable, secure bank connections.

What you can do

Assess whether a third-party tool like Plaid or Yodlee is a better fit for your business and banking needs.

Why it works

These services are built specifically for bank data aggregation. They have dedicated teams that maintain thousands of bank connections, making them highly reliable and resilient to bank-side changes.

Here’s how to implement a third-party solution

- Consult with a NetSuite implementation partner to find a suitable bank connector.

- Integrate the chosen third-party tool with your NetSuite instance.

- Configure the new connection and matching rules within NetSuite.

Frequently asked questions

Q1. Why does my bank disconnect from NetSuite?

Bank disconnections are typically caused by expired authentication tokens, multi-factor authentication (MFA) timeouts, or third-party API limitations from the bank’s side.

Q2. How often should I check my bank connection?

At least once a week as monitoring imports helps detect and fix issues early. An automated alert is typically sent upon disconnection, followed by a re-authentication code emailed to the client.

Q3. What happens if imports stop working?

You can manually export transactions from your bank and upload them into NetSuite until the automated connection is restored.

Q4. Is manual import reliable?

Yes. With correct categorization by experts (department, class, account), manual import remains a highly accurate backup method.

Q5. How can disconnection issues be minimized?

Maintain updated login credentials, enable 2FA integration, and schedule regular sync tests.

Q6. Can NetSuite handle multiple bank accounts?

Yes, NetSuite can connect to and import from multiple bank accounts, with each account’s transactions categorized separately by defined rules.

Q7. How does Sagelight help during disruptions?

We provide immediate troubleshooting, client guidance, perform manual imports, and implement long-term fixes to avoid repeat issues.

Q8. Are there more reliable alternatives for bank integration?

Yes, tools like Plaid, Yodlee, or custom APIs can provide more stable connections. We can help you assess and implement the best fit based on your bank and business requirements.

The Sagelight Accounting Solution

Sagelight Accounting ensures your NetSuite bank feeds never slow down your business. From troubleshooting disconnections to providing accurate framework to match bank data in NetSuite, our experts keep your financial data flowing smoothly, giving you accuracy, reliability, and peace of mind. Schedule a free consultation today.