Manual accounting is a liability in this age of automation. It’s a slow, error-prone process that consumes valuable time and talent, stifling a business’s ability to scale. The ideal solution isn’t to work harder; it’s to introduce accounting automation.

This guide provides a definitive framework for implementing automation in your accounting and finance functions. We will demystify robotic process automation (RPA) and other key technologies, offering a clear, actionable path to a more efficient, accurate, and scalable finance operation for your business.

What is automation in accounting and finance?

Automation in accounting and finance is the use of technology to streamline and execute repetitive, rule-based tasks without human intervention. This includes leveraging tools like Enterprise Resource Planning (ERP) systems, specialized scripts, and robotic process automation (RPA) to handle everything from data entry to financial reporting.

At its core, financial automation is about moving away from spreadsheets and manual data entry toward an integrated, automated workflow. For an e-commerce company, this could mean automatically reconciling sales from Shopify with bank deposits. For a real estate business, it might be automating rent collection and expense tracking.

Why is accounting automation essential for modern businesses?

Financial automation becomes critical when your business scales, manual errors become frequent, or you need faster, more reliable data for decision-making. It is no longer a luxury but a fundamental requirement for operational efficiency and competitive advantage.

- Scalability

- As your transaction volume grows, manual processes break down. Automation scales with you, handling increased loads without a proportionate increase in headcount.

- Error Reduction

- Humans make mistakes. Scripts and automated workflows execute tasks with perfect consistency, drastically reducing data entry errors and reconciliation discrepancies.

- Cost Reduction

- By automating repetitive work, you free up your finance team to focus on strategic analysis rather than data entry, effectively reducing operational costs.

- Enhanced Compliance & Audits

- Automated systems create a perfect digital audit trail. Every transaction is logged, validated, and reconciled, ensuring compliance and simplifying the audit process.

What processes can you automate in your finance department?

Virtually any repetitive, rule-based financial task can be a candidate for automation. The most impactfull automation target high-volume, low-value work.

- Accounts Payable (AP): Automate invoice processing, from receipt and data extraction to approval and payment.

- Accounts Receivable (AR): Automate invoice generation, dispatch, and payment reminders.

- Bank Reconciliation: Automatically match transactions from your bank feed with your accounting software, eliminating a time-consuming manual task.

- Payroll: Automate payroll calculations, tax deductions, and direct deposits.

- Financial Reporting: Generate real-time financial statements (P&L, balance sheets, cash flow) directly from live data.

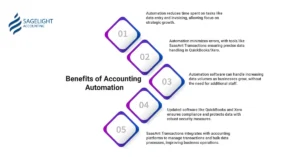

What are the key benefits of accounting automation?

Implementing accounting automation provides an immediate return on investment by improving accuracy, efficiency, and strategic capacity.

- Improved Accuracy

- Automated systems eliminate human data entry errors, leading to more reliable financial data and reporting.

- Increased Efficiency

- Processes that once took hours, like bank reconciliation, can be completed in minutes. This frees up your finance team to focus on higher-value work.

- Cost Savings

- Reduced manual effort and fewer errors directly translate into lower operational costs.

- Faster Decision-Making

- With real-time data and automated reports, you have instant access to the insights needed to make informed business decisions.

What are the best practices for implementing accounting automation?

A successful transition to financial accounting automation requires a structured approach and a clear strategy.

- Start Small

- Don’t try to automate everything at once. Identify one or two high-impact, repetitive processes like accounts payable or bank reconciliation—and start there.

- Choose the Right Technology

- The right ERP ensure the system integrates with your other business tools like NetSuite for mid-market and enterprise, or QuickBooks for small businesses.

- Communicate Clearly

- Involve your team from the beginning. Explain the benefits of automation and how it will free them from tedious tasks, not replace them.

- Establish Strong Governance

- Define clear rules and workflows. Regular audits are essential to ensure the automated systems are working as intended and maintaining data integrity.

What challenges should you anticipate?

While the benefits are clear, implementing automation in finance is not without its challenges. Addressing these upfront can ensure a smoother transition.

- Resistance to Change: Employees may be hesitant to adopt new technology. Clear communication and training are must to overcome this.

- Upfront Costs: The initial investment in software and implementation can be significant. However, the long-term ROI in efficiency and error reduction swiftly outweighs these costs.

- Integration and Scripting Errors: Poorly configured systems or scripting errors can lead to data integrity issues. This is where expert guidance is crucial to ensure a seamless setup.

Sagelight case study

An e-commerce client of ours, facing an explosion in order volume, decided to automate their financial operations using NetSuite scripts. They encountered problems with script errors. Causing repeated manual corrections, creating a cycle of inefficiency worse than manual process.

Our team at Sagelight Accounting intervened, conducting a comprehensive audit of their workflows. We identified the scripting flaws, resolved the integration challenges with error free accounting automation processes, and re-engineered the process for accuracy. This intervention not only fixed the errors but also reduced their monthly reconciliation time by over 70%, allowing them to reallocate their finance team’s efforts toward strategic inventory management.

Frequently Asked Questions

1. What is financial accounting automation?

Financial accounting automation is the use of software, such as ERPs like NetSuite or QuickBooks, to automatically handle routine tasks like data entry, bank reconciliations, and reporting.

2. Is automation too expensive for a small business?

No. Many cloud-based ERPs offer scalable plans. Small businesses can start by automating one or two key tasks to keep costs low while still realizing significant efficiency gains.

3. How can automation reduce errors in my financial data?

Automation removes the human element from repetitive tasks. Scripts perform data entry and consistent validation, eliminating manual typos and calculation errors.

4. Can automation replace my accountants?

No, automation in accounting and finance supports accountants. By handling tedious, low-value work, automation allows finance professionals to focus on strategic analysis, forecasting, and providing business insights.

Why choose Sagelight Accounting to future-proof your finances?

Manual accounting is a practice of the past. The future of finance is automated, integrated, and data-driven. At Sagelight accounting, we specialize in helping businesses, from real estate to e-commerce, navigate this transition. We guide you through ERP implementation, solve complex integration issues, and ensure your automated systems deliver accuracy and compliance from day one. Schedule a free consultation today.